When we hear the word «risk,» a sense of danger often comes to mind. However, this perception doesn’t hold true across the board. While some risks are undoubtedly negative, others have the potential to be embraced, precisely because they can add value and enhance customer service.

In today’s rapidly changing business landscape, organizations need to rethink their approach to risk and embrace opportunities for value creation. By understanding the intricate relationship between risk and opportunity, companies can unlock their potential for growth and success.

Here are some key considerations for rethinking risk and embracing opportunities for value creation:

- Setting a Clear Direction: It is essential for organizations to articulate a clear direction that outlines where the company is heading and how it will create growth and value. This direction should go beyond just focusing on lowering costs and error rates and emphasize the importance of value, impact, and meaning.

- Supporting Incentives for Value and Growth: Companies should provide support and incentives for workers to focus on value and growth. This includes investing in the necessary mindsets, tools, and capabilities that enable employees to embrace the value that humans can bring to work. By investing in the future of work, organizations can create an environment that fosters creativity and meaningful jobs.

- Solving Global Crises and Leveraging Technologies: Companies that will grow and create value are those that actively solve global crises, leverage exponential technologies, and adopt game-changing business models. By identifying and addressing unseen problems and opportunities, organizations can position themselves for success in the future.

- Embracing Risk: Embracing risk is crucial for creating value and growth. Companies should be selective about where they take risks and try new things, favoring incremental changes over radical ones. By embracing calculated risks, organizations can seize opportunities and drive innovation.

- Elevating Risk Management: Risk management should go beyond mere prevention and mitigation. It should be elevated to dynamic strategic enablement and value creation. This involves detecting potential new risks and weaknesses, determining risk appetite, and making informed decisions that facilitate effective business outcomes.

By rethinking risk and embracing opportunities for value creation, organizations can position themselves for success in an ever-changing business landscape. It requires a shift in mindset, a focus on innovation, and a willingness to embrace calculated risks. With the right approach, companies can unlock their potential and thrive in the future.

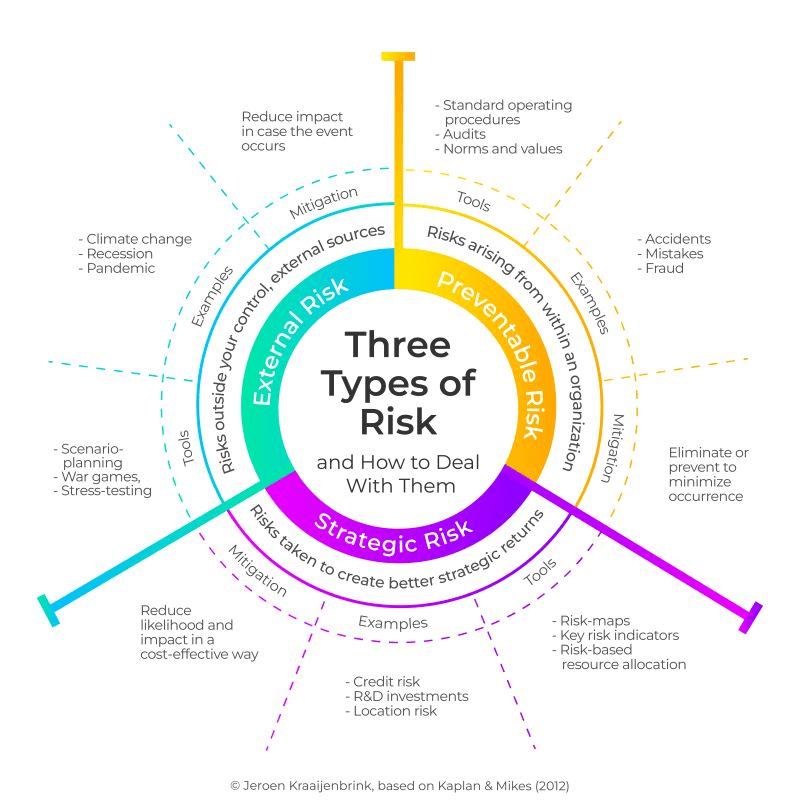

About a decade ago, back in 2012, Robert S. Kaplan and Anette Mikes authored a thought-provoking piece in the Harvard Business Review titled «Managing Risks: A New Framework«,Within this article, they introduced a valuable typology consisting of three distinct categories of risk:

Type 1: External Risk

Definition: Risks stemming from external factors beyond an organization’s control.

Examples: Climate change, economic downturns, pandemics.

Mitigation: Strategies to minimize the impact if the risk eventuates.

Tools: Scenario planning, war gaming, stress testing.

Type 2: Preventable Risk

Definition: Risks originating from internal processes and actions within an organization.

Examples: Accidents, errors, fraudulent activities.

Mitigation: Measures to eliminate or curtail the likelihood of occurrence.

Tools: Standard operating procedures, audits, adherence to norms and values.

Type 3: Strategic Risk

Definition: Risks undertaken with the aim of achieving superior strategic outcomes.

Examples: Credit risk management, investments in research and development, location-based risks.

Mitigation: Strategies to cost-effectively reduce the probability and impact.

Tools: Risk mapping, key risk indicators, allocation of resources based on risk assessment.

In a nutshell, the three categories advocate preparing for external risks, preventing avoidable risks, and carefully managing strategic risks.

Of these three classifications, Strategic Risk stands out as the most intriguing. Unlike the other types, strategic risks possess the potential to significantly enhance a company’s value and become an integral aspect of its overarching strategy. This prompts a compelling question:

→ Can assuming GREATER risk enhance the performance of our organization?

While this notion may appear counterintuitive from a risk management standpoint, it’s a concept that’s more prevalent than we might initially assume. Transferring risk from customers, in fact, is a common approach to adding value. Consider the following examples:

- Various insurance policies

- Payment structures, notably no-cure-no-pay arrangements

- Leasing and rental models

- The «X as a service» paradigm

To conclude, here’s a comprehensive approach to dealing with risks based on the aforementioned categories:

- Identify all risks confronting your organization.

- Categorize these risks into the three defined types.

- Develop strategies to mitigate the potential impact of external risks.

- Implement measures to reduce the likelihood of preventable risks.

- Explore and evaluate strategic risks that align with your objectives.

- Systematically manage the likelihood and consequences of strategic risks.

Recommended Reading:

- Managing Risks: A New Framework

- To Understand Risk is to Understand the Opportunity to Create Value

- Redefining Work for New Value: The Next Opportunity

- The next leap in value creation: How Game Changers are defining the future of business

- A pragmatic pathway for redefining work

- How to embrace risk to create value

- Meeting the future: Dynamic risk management for uncertain times

Deja un comentario